How To Identify A Dead Cat Bounce

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

A dead cat bounce is a particularly colorful way of describing a sudden, seemingly inexplicable swing in momentum within a specific asset or market. One recent example took place during the 2008 financial crisis . For months, investors sat on pins and needles, eager for the market to recoverand experienced a glimmer of hope when the Dow Jones saw an upswing in prices mid-year. Some investors trusted this was the market recovering and jumped on the opportunity to buy shares. Unfortunately, it was only a dead cat bounce created by the false demand of the assets.

In truth, prices continued to plunge until early 2009when the market finally saw its lowest point. Thus, investors who purchased securities during the growth blip probably didnt see the profitability they were hoping for.

Unless investors are intentionally engaging in trend trading, being able to differentiate apparent trends like a dead cat bounce from actual market data may help in making more well-informed investment decisions.

Learn To Trade Stocks Futures And Etfs Risk

Dead Cat Bounce

Above you are looking at the 3-minute chart of Netflix from June 20, 2016. The image displays a strong bearish trend, which started in the $95.80 range.

In the blue ellipse, you see that the price increases shortly and then returns back to its bearish trajectory. The increase in the blue area is the dead cat bounce zone.

As you see, the Cat dies first; then it hits the bottom and bounces higher. If you take a closer look, you will see that there are few more dead cat bounces in the further price decrease.

An Example During The 2008 Financial Crisis

The True Low of the Dow Jones Index

During the 2008 Global Financial Crisis2008-2009 Global Financial CrisisThe Global Financial Crisis of 2008-2009 refers to the massive financial crisis the world faced from 2008 to 2009. The financial crisis took its toll on individuals and institutions around the globe, with millions of American being deeply impacted. Financial institutions started to sink, many were absorbed by larger entities, and the US Government was forced to offer bailouts, the Dow Jones Industrial Average dropped to a low at the beginning of 2009 . It was an optimal time to buy assets included in the Dow Jones as the market index continued to rise from that point on, providing investors an opportunity to sell high in the future.

The Dead Cat Bounce for the Dow Jones Index in 2008

There was another increase in the DJIADow Jones Industrial Average The Dow Jones Industrial Average , also referred to as “Dow Jones or “the Dow”, is one of the most widely-recognized stock market indices. mid-2008 that was not reflective of the index price recovering. Instead, it was a falsely identified price trough.

Investors who believed that the economy was recovering purchased shares and fabricated demand for the assets in the Dow Jones Index. The fabricated demand can be seen from the graph above as the temporary spike in the price. However, as it was a dead cat bounce, the price continued to plummet shortly after the sudden rise.

Read Also: What Happens When Your Allergic To Cats

What Causes A Cat To Bounce

There comes a time in every bear market when even the most ardent bears rethink their positions. When a market finishes down for six weeks in a row, it may be a time when bears are clearing out their short positions to lock in some profits. Meanwhile, value investors may start to believe the bottom has been reached, so they nibble on the long side. The final player to enter the picture is the momentum investor, who looks at their indicators and finds oversold readings. All these factors contribute to an awakening of buying pressure, if only for a brief time, which sends the market up.

Limitations In Identifying A Dead Cat Bounce

As mentioned above, most of the time a dead cat bounce can only be identified after the fact. This means that traders that notice a rally after a steep decline may think it is a dead cat bounce when in reality it is a trend reversal signaling a prolonged upswing.

How can investors determine whether a current upward movement is a dead cat bounce or a market reversal? If we could answer this correctly all the time, we’d be able to make a lot of money. The fact is that there is no simple answer to spotting a market bottom.

Also Check: Cat Ate Chocolate

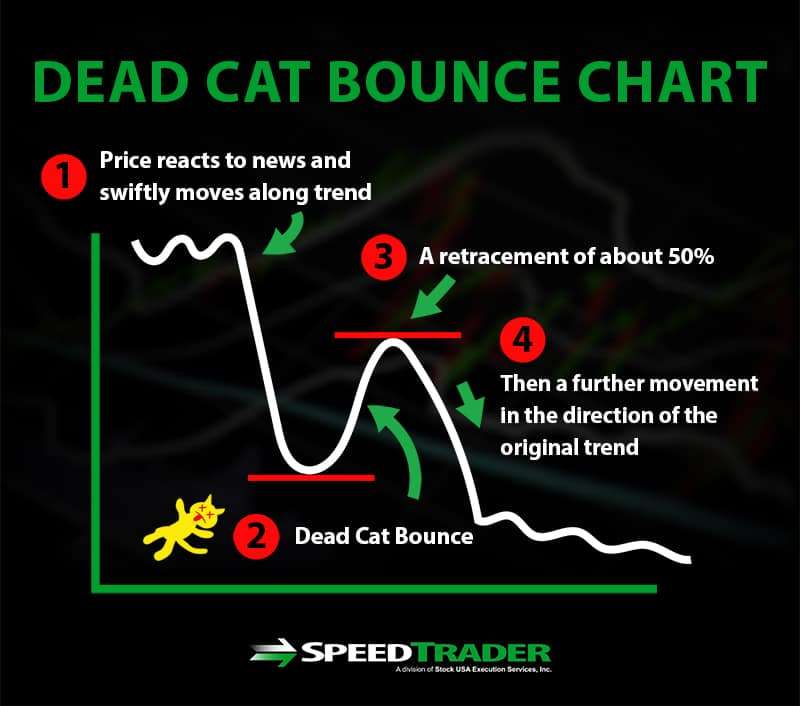

What Is The Dead Cat Bounce Pattern

The dead cat bounce pattern is a specific stock chart phenomenon that occurs during a long downtrend. It means, as the term suggests, that anything can rebound when it falls from a significant height. It is a short term reversal bounce that takes place in the context of a very long downtrend. In simple words, the pattern is a most-welcomed correction of a long bearish trend, even though it occurs for a very short duration that is followed by the descent again.;

It is often triggered by short-covering and it appears on the chat as a sharp V-shaped reversal. The V-shaped pattern of the bounce forms at the very bottom of an extensive sell-off in the stock market.;

A dead cat bounce pattern is generally considered only as a price pattern but that is not all. It can also help to explain the participants repositioning in the market. When the traders assume that the market has reached the lowest, they tend to close short positions to lock profits. Hence, traders move to the long side of the market hoping that market has already oversold and now is the time to bounce back. That is the reason that it got its funny name dead cat bounce. The stock markets of Malaysia and Singapore bounced, after a long downtrend, for a very short interval in December 1985. The Financial Times used this term for the very first time to describe the incident.;

Dead Cat Bounce Stop Loss

The dead cat pattern could prove deadly if you dont use a stop loss order. What if you are wrong and this is not a dead cat bounce pattern? What if you are actually short selling a stock, which has put in a significant bottom and ready to make a strong move higher.

When these reversal moves occur, they are sharp and fast.; This pain of course can intensify itself if you are trading on margin.

Trading a Dead Cat Bounce without a Stop Loss

In the image above, we see symptoms of a real-life dead cat bounce pattern:

That is a sure deal right? So, why place a stop loss order?

Dead Cat Bounce Trade Gone Wrong

When reviewing the above chart, you might say to yourself, No big deal! It will definitely start dropping again!

You think so?

Dead Cat Bounce No Way Out

Now what? A simple continuation trade will lead to enormous financial and emotional pain. This sharp counter move higher all took place in less than an hour!

For this reason, you will always want to place a protective stop loss order when trading the dead cat bounce pattern.

The correct location for your dead cat bounce stop loss is above the peak created during the bounce.

Since this might confuse you, I will show you where your stop loss should be in the previous trade demonstrations:

Dead Cat Bounce Proper Stop Loss

You May Like: How To Keep Cats Off My Car

Is The Dead Cat Bounce Underway For Bitcoin Ethereum And Dogecoin

So, yeah, its a horrible day for cryptocurrency investors. Every major digital currencyfrom Bitcoin to Dogecoinis down a staggering amount as China has widened its crackdown on cryptos. But virtually all of them are also already seeing some sort of recovery.

The question is, are investors buying on the low to send their crypto of choice higher? Or is this a dead cat bounce?

The term dead cat bounce, used to describe a short-lived recovery from a prolonged decline, always pops up when you see a small rally after a downward trend. And all major cryptos have seen them at one point or another. Bitcoin, for example, saw several in 2018, as prices fell from $13,4349 at the start of the year to just over $3,800 at the end. And Ethereum saw a big one in April of that same year, with prices nearly doubling from $383 to $687 before falling to $139 by Dec. 31.

Whether its a bounce or the start of a comeback, heres whats certain as of 11:15 a.m. ET: Bitcoin has regained over $5,000 in value from the lows it hit at 9:10 a.m. ET, according to Coindesk. Ethereum is up $534. And Dogecoin has rebounded from 22 cents to 37 cents.

Other cryptos are following the same pattern: Cardano, XRP, Litecoin, and Maker have all seen bounces since just after 9 a.m. ET.

Or, of course, this could just be a bump in the road for cryptocurrencies.

This story was originally featured on Fortune.com

How Can You Tell

Its important to note that there is no precise definition for a dead cat bounce. Generally speaking the elements are:

- The stocks price has fallen consistently;

- The stock regains value again, but for a short time;

- The stock loses value again, falling below its previous low point.

This can make it difficult to spot a dead cat bounce when one is happening.

The truth is, theres no way to tell the difference between a dead cat bounce, a rally and a revaluation until after the fact.

If the price fluctuates around some mid-range price, it indicates that the market has found a new stable value for this stock. In our example above, say that Grow Co.s price declines to $75 then ticks back up to $85. It then generally moves within a range of $70 and $80. In this case Grow Co. has not experienced a dead cat bounce. It has found a new stable value.

At the same time, at first a dead cat bounce appears to be a rally. In some cases this might be true. The only difference between a bounce and a rally is when the stock turns around and comes back down to earth. Typically the only way to determine this in advance is by studying the fundamentals of the underlying asset .

If you think the company is currently undervalued, price gains might reflect a rally. If you think the company remains weak, it is likely an illusion.

Read Also: Is Clumping Litter Bad For Cats

Is A Stock Rally Sustainable Or Will The Price Continue To Fall

A dead cat bounce is an investing term for the temporary rise in the price of a stock or other asset during a long period of decline. While the term is a bit morbid, it comes from the idea that if it falls far enough, even a dead cat will bounce. A dead cat bounce in investing is a “sucker’s rally” that can entice investors to put money into a troubled company.

Technically speaking, a dead cat bounce can only be identified;after it happens. The “bounce” is the short-term price increase that is preceded and followed by decline, with the second decline bringing the share price to new lows. Until the second decline occurs, there’s no way to know whether a share price increase is a dead cat bounce or the beginning of an actual, sustained recovery of the stock’s value.

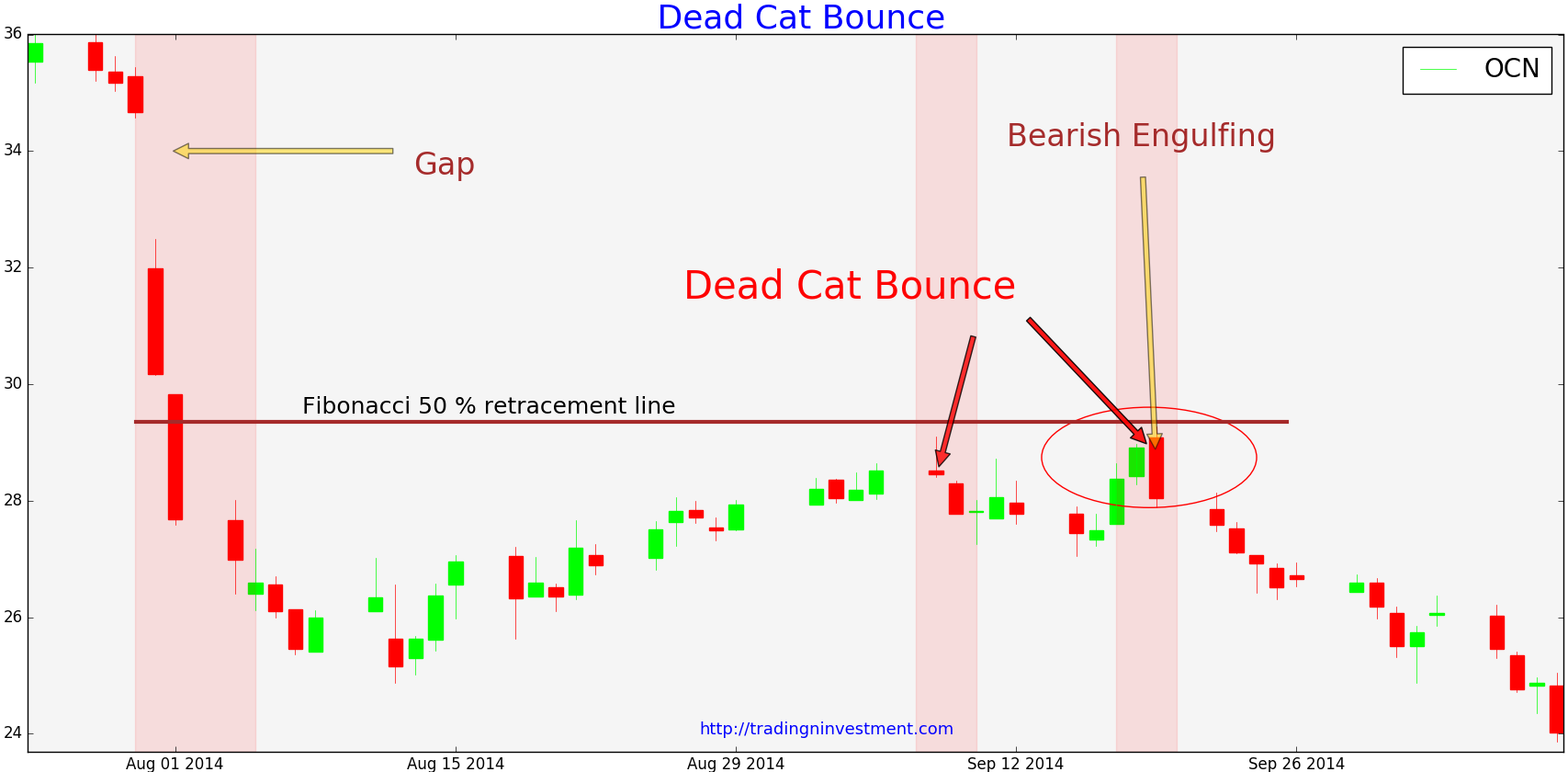

Dead Cat Bounce Part 1

Investor psychology comes into play because traders are likely to become fearful at the same price levels that they have been fearful before. We use the DCB to identify those price levels for potential breakouts.

The pattern consists of a gap during a downtrend when prices have moved between the close of one day and the open of the next trading day. The larger the gap is the more significance technicians will assign to the pattern. The gap is typically created by unexpected news appearing after or before normal market hours.

The gaps indicates that traders have overreacted to the data, the stock is likely to become oversold at some point and will begin to retrace back towards the gap. The top and bottom of the gap will act as resistance barriers and if the market or stock peels off of these resistance levels, the subsequent decline can be quite significant.

The rally back towards the gap is a good example of a bull trap and the final decline that completes the pattern can be larges and fast as a feedback loop of stop losses push more sellers into the market.

Read Also: What Does A Broken Cat Tail Look Like

How To Trade Dead Cat Bounces

There are two main things you need to know about dead cat bounces. First, you should always avoid timing the market. By this, we mean that you should avoid going against the overall trend especially when more news is coming in.

»Follow the Crowd Trading Strategy«

For example, on coronavirus, you should avoid going long when the market and news media are continuing to focus on the news.

Second, you should always wait before you go against a trend. In other words, you should follow the trend. This means that you should wait for a new trend to form and then you follow it.

In other words, wait for a trend to form and then buy the asset.

Finally, you should use several tools to guide you when trading the dead cat bounce. Some of the popular tools you could use are Andrews Pitchfork and the Fibonacci retracement. These tools have several key levels to watch as you try to confirm the new trend.

Also, you should use technical indicators like moving averages and Bollinger bands to confirm the new trend. And dont forget this: You should always have a stop loss on all of your trades!

The Timing Of The Dead Cat Bounce

Most traders are familiar with the “dead cat bounce”: a temporary price recovery following losses, that is followed by more losses. But when does the bounce occur and when do the losses resume?

Using end-of-day price data for US stocks, I identify all stocks that suffered one-day losses of -10% or more.

prices = get_pricescloses = prices.locopens = prices.locbig_losers = closes.pct_change <= -0.10

I then look at returns over the subsequent day, breaking them into overnight and intraday returns.

oc_returns = / opensco_returns = ) / closes.shiftoc_returns = oc_returns.where)co_returns = co_returns.where)

Plotting the returns reveals that stocks gain 40 BPS overnight, on average, following steep losses, but then lose over 50 BPS on average during the next day’s session.

Don’t Miss: Why Does My Cat Touch Me With Her Paw

A Dead Cat Bounce Suggests That More Weakness Is Likely To Emerge In The Near Term

Topics

https://mybs.in/2ZcwPZv

As per the theory, a dead cat bounce is a continuation pattern where the bounce is expected to hit strong resistances and re-join the earlier downward trend. A dead cat bounce, thus, is believed to be short-lived.

The name Dead Cat bounce is based on the notion that even a dead cat will bounce, if it falls far or falls with a high speed. However, it has been observed, especially in recent times, that a dead cat bounce often leads to a firm reversal, on the back of follow-up buying. Implications: — Although, a dead cat bounce suggests that more weakness is likely …

TO READ THE FULL STORY, NOW AT JUST Rs

Key stories on business-standard.com are available to premium subscribers only.

Already a premium subscriber?

A Volatile Week For Stocks Has Brought Back A Bizarre Feline Term

Its been a volatile week for the stock markets. On Monday, the Dow Jones Industrial Average and the other major indexes posted their biggest drop in months, fueled by fears over a tariff war between the U.S. and China. But since then, stocks have climbed, offsetting the earlier losses.

Was this a dead-cat bounce? asked Jim Giaquinto of Zacks Investment Research after the markets brightened on Tuesday. Well find out soon enough.

Also Check: How To Get Rid Of Cat Allergies Forever

Dead Cat Or Market Reversal

As we noted earlier, after a long sustained decline, the market can either undergo a bounce, which is short-lived or enter a new phase in its cycle, in which case the general direction of the market undergoes a sustained reversal as a result of changes in market perceptions.

This image illustrates an example of when the overall sentiment of the market changed, and the dominant outlook became bullish again.

How can investors determine whether a current upward movement is a dead cat bounce or a market reversal? If this could be answered correctly all the time, investors would be able to make a lot of money. The fact is that there is no simple answer to spotting a market bottom.

It is crucial to understand that a dead cat bounce can affect investors in very different ways, depending on their investment style.

It’s critical to understand market fundamentals to determine if an uptick in the market is a dead cat bounce or a market reversal before making further investment decisions.